Ever wondered how you can protect your financial future from inflation? In an era of rising costs and uncertainties, it’s essential to find ways to secure our financial well-being. One effective strategy is to think of insurance as a safety net.

In this blog post, we will explore the value of life insurance in protecting your financial future, particularly term insurance benefits. By understanding the benefits and tax advantages of term insurance, you can make informed decisions that will safeguard your loved ones and provide financial security.

What is Term Insurance?

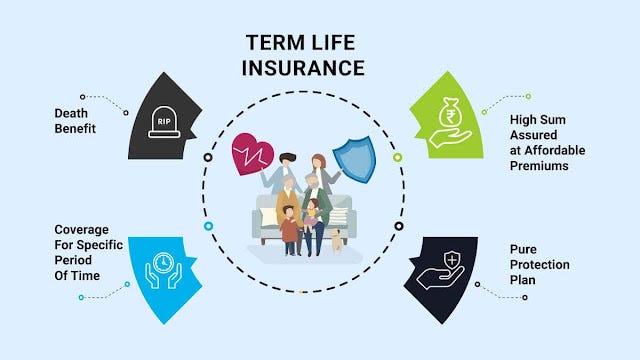

Term insurance is a type of life insurance that provides the policyholder with coverage for a specific amount of time. The company pays the nominee the death benefit in the event that the insured person passes away within the duration of the policy.

Why Do You Need Term Insurance?

Many individuals opt for term insurance to ensure the financial security of their loved ones in the future. In the unfortunate event of the life insured’s demise and during challenging times, the payout from a term insurance plan can serve as vital financial support.

Also, term insurance premiums may be comparatively lower than other plans’ premiums. This may be because term insurance policies do not have any savings or investment element as a part of their structure.

What are the Benefits of Having Term Insurance

Now that you know what a term insurance means, let’s take a look at some of the term insurance benefits in detail:

Locked-in Premiums for Affordable Protection

When it comes to protecting your family’s financial future, term insurance stands out as a solid choice. One of the significant term insurance benefits is locked-in premiums. Unlike other forms of insurance where premiums may increase over time, term insurance allows you to lock in a premium amount that remains the same throughout the policy’s duration. This means that regardless of inflation, your premium will stay affordable and predictable.

For example, let’s say you are 30 years old and purchase a 20-year term insurance policy with a premium of ₹10,000 per year. This premium amount will remain unchanged for the entire 20-year period, providing you with long-term stability and peace of mind knowing that your loved ones are financially protected.

Maximum Benefits at Lower Premiums

Buying life insurance early in life offers several advantages, including lower-cost protection. As we age, premiums tend to increase due to factors such as inflation and changes in risk profiles. By purchasing term insurance at a young age, you can take advantage of lower premiums while still ensuring sufficient coverage for your family.

Let’s consider an example to illustrate this point. A 25-year-old individual purchasing a term insurance policy may pay a significantly lower premium compared to someone who buys the same policy at the age of 40. By acting early, you can lock in lower premiums and potentially save substantial amounts over the policy’s duration.

Long-Term Stability and Inflation-Proofing

One of the key challenges posed by inflation is its impact on our expenses and financial stability. As prices rise, our purchasing power diminishes, making it harder to maintain our desired standard of living. However, life insurance can provide long-term stability and act as a shield against the erosive effects of inflation.

Consider this hypothetical scenario: You purchase a term insurance policy with a sum assured of ₹50 lakh. Over time, due to inflation, the cost of living doubles. However, your term insurance benefit remains unaffected by inflation. In this way, term insurance acts as a safety net that protects your loved ones from the financial impact of rising prices.

Tax Benefits for Enhanced Savings

In addition to providing financial security, term insurance also offers tax benefits under Section 80C and Section 10(10D) of the Income Tax Act. By availing these tax deductions, you can further enhance your savings and ensure that your hard-earned money is put to good use.

Under Section 80C, you can claim a deduction of up to ₹1.5 lakh on the premium paid towards your term insurance policy. This reduces your taxable income and lowers your overall tax liability. Additionally, under Section 10(10D), the maturity proceeds or death benefit received from a term insurance policy are exempt from tax.

Let’s consider an example to illustrate how term insurance tax benefits work. Suppose you are in the highest income tax bracket (30%) and pay an annual premium of ₹20,000 for your term insurance policy. By claiming the deduction under Section 80C, you can save up to ₹6,000 in taxes each year.

Conclusion

Insurance is not just a financial product; it is a safety net that protects your loved ones and provides peace of mind. By considering term insurance benefits and understanding the tax advantages it offers, you can secure your financial future while enjoying long-term stability and protection against inflation. So, take the necessary steps to protect your financial future by exploring term insurance options that suit your needs. By doing so, you can build a solid foundation for your loved ones’ well-being and enjoy the peace of mind that comes with being prepared for any eventuality.